Press Releases

CBK Raises the Discount Rate by a Quarter Percentage Point

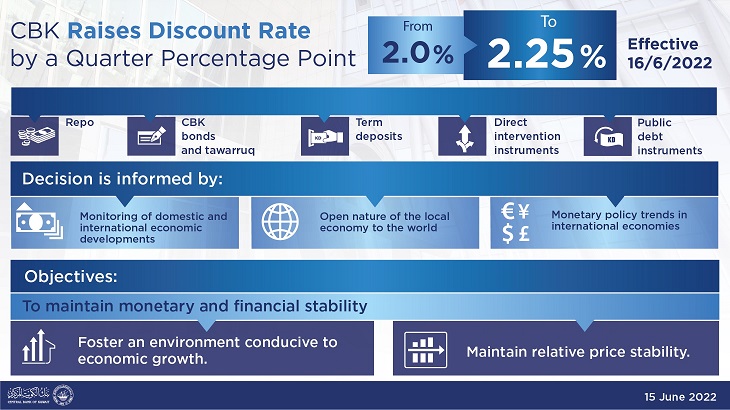

The Governor of the Central Bank of Kuwait (CBK), Basel A. Al-Haroon, stated that the CBK Board of Directors decided to raise the discount rate by 0.25% from 2.00% to 2.25% effective June 16, 2022. The CBK also decided to change the rates of monetary policy instruments by varying percentages for the entire interest rate yield curve, including repurchases (Repo), CBK bonds and tawarruq, term deposits, direct intervention instruments, as well as public debt instruments.

This decision reflects the CBK‘s incessant monitoring of domestic and international economic and geopolitical developments that resulted in high global inflation rates, mainly driven by increased commodity and energy prices and continuous supply chain disruptions, which constitute a key source of imported inflation affecting the consumer price index in the State of Kuwait. The CBK decision also considered the open nature of the Kuwaiti economy that imports most of its commodities.

The Governor added, the decisions taken by the Central Bank of Kuwait around changes to the discount rate, whether by raising or cutting, are informed by thorough assessments of the latest local and global economic data and considerations of the monetary policy that is intended to provide an environment conducive to sustainable economic growth, in particular the non-oil GDP, considers Kuwait’s relations with the world countries and, hence, monitors the movements on global interest rates to determine the appropriate rate for Kuwait conducing to growth of KWD private deposits, which constitute a key source of finance of the national economy.

The Governor further explained that the decision considered, inter alia, the factors affecting the Consumer Price Index to assess the pressure on such prices. The CBK also considers the local factors affecting the inflation rates including the monetary factors stimulating the overall local demand.

The Governor concluded that CBK shall continue to closely monitor the local and international economic, monetary, and banking developments, and, whenever appropriate, shall use the available monetary policy instruments to safeguard financial and monetary stability.